On-Chain Asset Management Falls Short for Institutional Investors

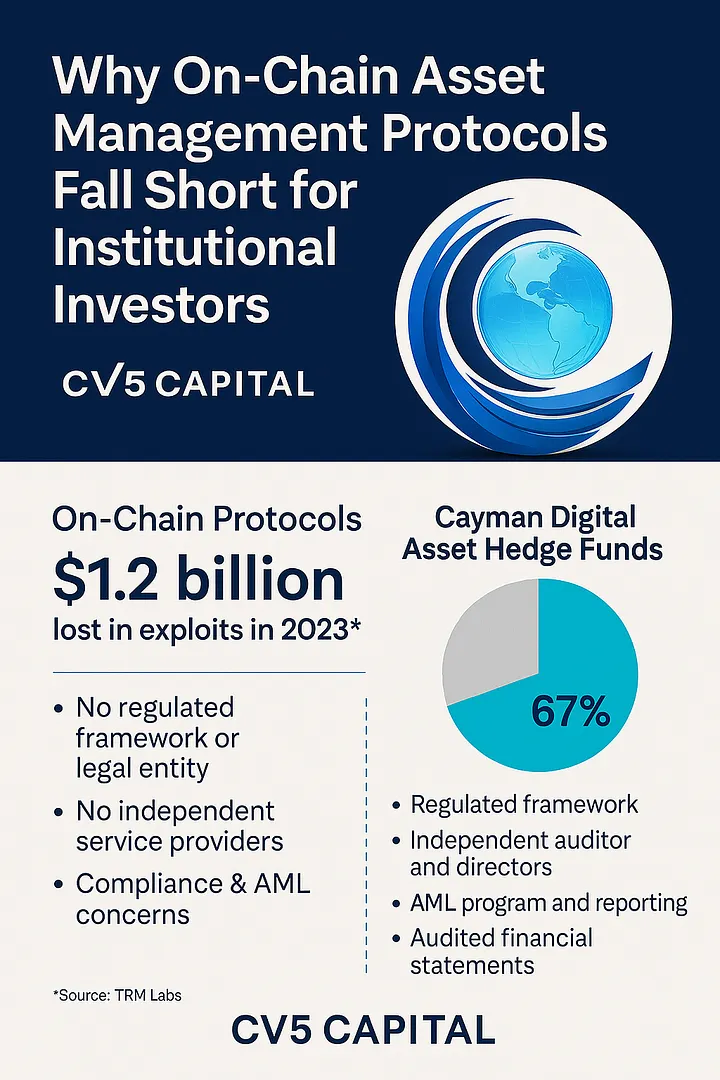

As digital assets mature, institutional appetite for exposure to crypto and decentralized finance (DeFi) has grown. In parallel, on-chain asset management and lending protocols have emerged, promising efficiency, transparency, and composability. However, for institutional investors — particularly those accustomed to traditional Cayman-domiciled hedge fund structures — these protocols still fall short of the robust requirements around regulation, governance, compliance, and risk management.

Despite the innovation and potential of on-chain finance, institutional allocators need more than code and smart contracts. They need trust, accountability, and legal recourse. Let’s explore why most on-chain asset management platforms are still not viable for serious institutional capital.

1. No Regulated Framework or Legal Entity

Cayman hedge funds operate within a well-defined legal framework, typically under the Cayman Islands Mutual Funds Act, regulated by the Cayman Islands Monetary Authority (CIMA). These funds have:

Clearly delineated legal entities with statutory and common law application through the Courts.

- A board of directors

- Licensed Registered office providers

- AML officers and compliance programs

- Rules on corporate governance, segregation of assets, calculation of assets, conflicts of interest apply with enforcement for breaches by the regulator.

In contrast, most on-chain protocols have no legal wrapper. They may be governed by a DAO (Decentralized Autonomous Organization), or worse, by unaudited anonymous developers with no jurisdictional accountability. This presents a major red flag for allocators subject to fiduciary duties and regulatory scrutiny.

2. No Independent Service Providers

Institutional investors expect independent, reputable service providers including:

- Fund administrators

- Custodians

- Auditors

- Legal counsel

- Independent directors

These third parties ensure oversight, segregation of duties, and operational transparency. On-chain protocols generally lack any independent verification of performance, AUM, or investor allocations. Audits, if any, are often limited to “smart contract audits” (focused on code bugs, not financial accuracy).

Traditional Cayman structures, by contrast, require audited financials annually, typically prepared by top-tier audit firms and filed with the regulator.

3. Compliance & AML Obligations

KYC/AML regulations are non-negotiable for institutional allocators. Cayman hedge funds appoint AML Compliance Officers (AMLCO), Money Laundering Reporting Officers (MLRO), and Deputy MLROs (DMLROs) as required by Cayman law. They also perform investor due diligence, screening, and ongoing monitoring.

On-chain protocols operate pseudonymously, with no built-in AML or investor verification. While some solutions attempt to bolt on KYC infrastructure, these are still immature and often optional. Technology providers for AML might screen wallets but how do they verify the ownership of the wallets by the user’s in question? The answer is they do not. What risk category is assigned to a user if any? All of these questions go unanswered.

4. Cybersecurity & Protocol Risk

Smart contracts are not immune to risk. In fact, DeFi exploits have cost investors billions. Some examples:

- UPCX Protocol Hack (April 2025): $70 million lost after a compromised account enabled a malicious smart contract upgrade.

- bZx Protocol Hack (2020): Multiple incidents led to over $8 million in losses due to code vulnerabilities and oracle manipulation.

- Cream Finance (2021): A $130 million exploit due to a re-entrancy attack on a lending protocol.

- Euler Finance (2023): A major exploit saw $197 million drained, despite multiple audits.

These incidents highlight the inherent risks of code-based governance, flash loan vulnerabilities, and reliance on oracles. According to Halborn’s 2025 report:

- Total losses from top 100 DeFi hacks: $10.77 billion

- Most targeted chains: Ethereum, BSC, Bitcoin, Polygon, and Arbitrum

These figures highlight the significant financial risks associated with DeFi protocols lacking institutional safeguards.

Cayman-domiciled funds, on the other hand, implement multi-layered cybersecurity controls, utilize insured custodians (e.g., Fireblocks, Anchorage, Copper), and conduct independent penetration testing.

5. Lack of Fiduciary Oversight

Traditional hedge funds appoint independent directors who are legally and professionally obligated to act in the best interests of the fund and its investors. They review compliance, NAV reporting, conflicts of interest, and key decisions.

In contrast, DeFi protocols operate without oversight — no board minutes, no governance logs (beyond token voting), and no fiduciary liability.

6. No Audited Financial Statements

Cayman funds must submit audited financial statements annually to CIMA. This provides institutional investors with:

- Verified valuation of assets

- Disclosure of risk exposures

- Confirmation of fund expenses and performance

On-chain protocols lack this accountability. Token holders or LPs in protocols receive unaudited dashboards that can be manipulated or display incorrect information due to oracle failures, code bugs, or even malicious activity.

Bridging the Gap: Not Impossible, Not There Yet

Some hybrid models are emerging — regulated funds that interact with DeFi under controlled conditions. For example, tokenized fund shares or on-chain vault strategies operated within a Cayman fund wrapper. These may represent the future, but currently, pure on-chain protocols do not meet the bar for institutional-grade compliance, governance, and risk controls.

Final Thoughts

On-chain asset management protocols offer compelling innovation, real-time settlement, transparency, and composability. But for institutional allocators bound by legal, fiduciary, and operational frameworks, they are not a substitute for traditional fund structures governed under Cayman law like CV5 Capital.

Until DeFi evolves to integrate the core tenets of institutional finance, regulation, independent verification, fiduciary duty, and risk management, it will remain a sandbox for retail and crypto-native players, not institutional capital. By leveraging the strengths of traditional fund structures and embracing DeFi’s potential, firms like CV5 Capital are paving the way for secure and compliant digital asset investments.

Author’s Note: This article is not investment advice. It is intended to provide an informed overview of the current limitations of on-chain asset management protocols from an institutional investor’s perspective. For guidance on structuring Cayman digital asset funds or bridging traditional finance with DeFi, consult CV5 Capital.